I welcome comments, feedback and opportunity to learn more or collaborate. Tweet @manas8u

What is risk?

In this document, I will be focussing on elements of risk relevant to Value Based Care and therefore, risk would mean financial risk with respect to health insurance premiums. Two dimensions are of particular relevance to this discussion of financial risk: (1) objective risk and (2) subjective risk. Objective risk is when the risk inherent in an uncertain outcome is known. For example, the flip of a coin has only objective risk. It is uncertain whether the flip will result in a head or a tail, so the flip is risky, but the probability of flipping a head or tail, 50 percent, is known. Probability of a 65 year old male needing a coronary artery bypass (and its associated costs) are an example of objective risk. Subjective risk occurs when the probability distribution itself is uncertain. For example, a particular weather forecaster may predict that the chance of rain is 20 percent, but different forecasters may attach different probabilities to the event. This occurs with events that are rare with respect to attribution size (e.g. Covid, Transplant related costs). Managing objective risk is a key activity of health insurance organizations and when provider organizations accept risk. This requires provider organizations to develop and use tools such as Utilization Management, Disease Management/Care Management, accurate assessment and reporting of clinical risk (‘risk adjustment’) while also maintaining necessary financial reserves to cover the subjective risks assumed by insurance companies.

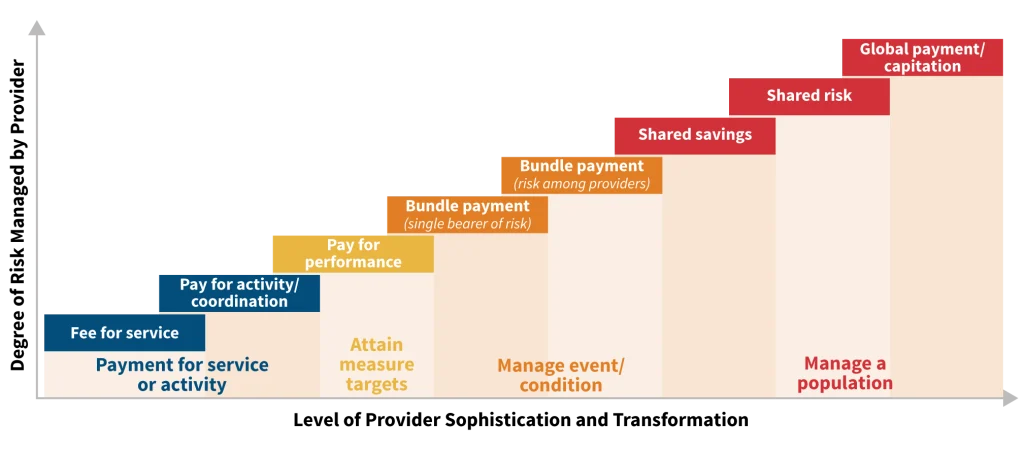

Providers and provider organizations bear financial risk (with respect to insurance premiums) on continiuum. Providers can start at one part of continum and might move to different part of continuum by contracting with different payers. Sometimes providers could be contracting with same payor on different arrangements e.g. organizations might be in a Medicare Shared Savings ACO while also participating in a bundled program.

Why providers consider risk?

Providers and provider organizations consider accepting ‘risk’ for diverse reasons. However, the commonly offered reasons are

- Maintain and/or grow their members, services, fees, and/or revenue

- Manage, transform or reduce their operating expenses (internal efficiency, consolidation,etc.)

- Maintain and/or grow their net income (earnings) – which is their primary financial goal

- Reduce wasted services across the entire system

Types of Risk Arrangements

Risk arrangements typically fall into one of three categories: primary care capitation, professional services capitation, and global, or full-risk, capitation. Organizations bearing capitation can contractually ‘distribute’ risk e.g. institutional subcapitation or specialist subcapitation.

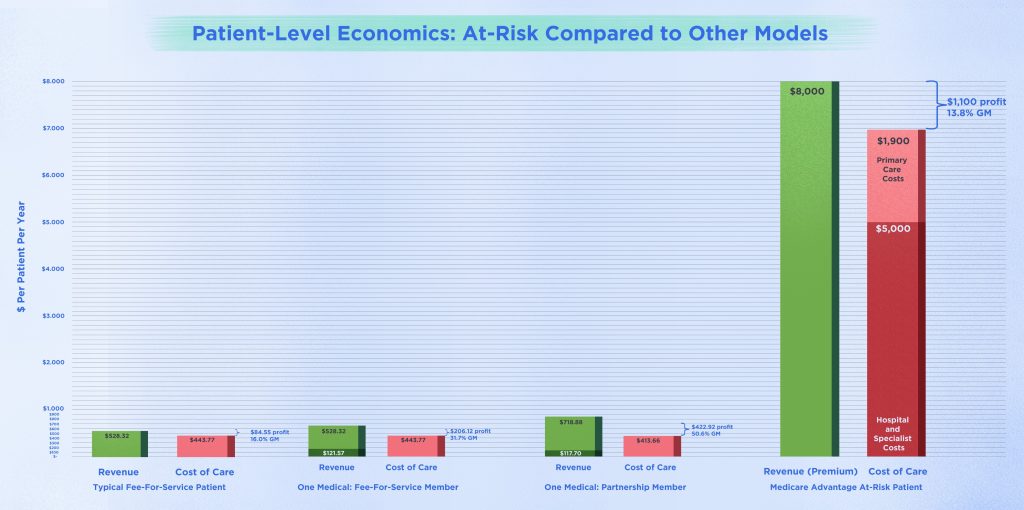

In Global Capitation, a payor passes to a provider organization all or most of the amount of the premium dollar allocated to pay for physician services, including hospital, skilled nursing facility, and home health, and for ancillary services, including laboratory and ambulance, durable medical equipment, and sometimes a part of pharmaceutical costs. Full risk capitation gives a medical group control over approximately 80% of the premium dollar, more leverage in negotiating contracts with hospitals, specialists, and ancillary service providers, more cash flow to invest in creating utilization management and quality improvement systems, the opportunity to retain all the profit from savings these systems generate, the opportunity to develop wider expertise in managing care, and the opportunity to better coordinate care and to allocate dollars where they will have the most impact on patients’ health. As organizations accept this risk (and premium), payors can delegate/accompany this risk transfer some services to the capitated group to offset/manage risk e.g. Utilization Management and Care Management. In this process, the physician organizations generally uses its own standards of care and treatment guidelines, approved by the payors but not dictated by them, to assure consistency and appropriateness in patient treatment. This is attractive to providers having consistent processes, guidelines if they are delegated by multiple payors covering most of their panel/patients. Depending on provider and payor experience and sophistication, payors might retain some elements of managed care services e.g. Credentialing, Claims payment, Network, Appeals, Contracting, Marketing (see sidebar). Depending on the size and stage of maturity, payor might even retain some elements deemed less critical for managing risk e.g. Credentialing or Utilziation of Home Health/DME. In California, only an organization with a special state license (known as a limited Knox-Keene license) is permitted to assume global risk for both professional and institutional services in California. In CMS Direct Contracting Global Model/Total Care Capitation (TCC), the capitated entities are capitated for any eligible Part A and Part B service provided to an attributed beneficiaries with certain exceptions (e.g., claims that contain any substance abuse service or claims from beneficiaries who have opted out of data sharing will not be included).

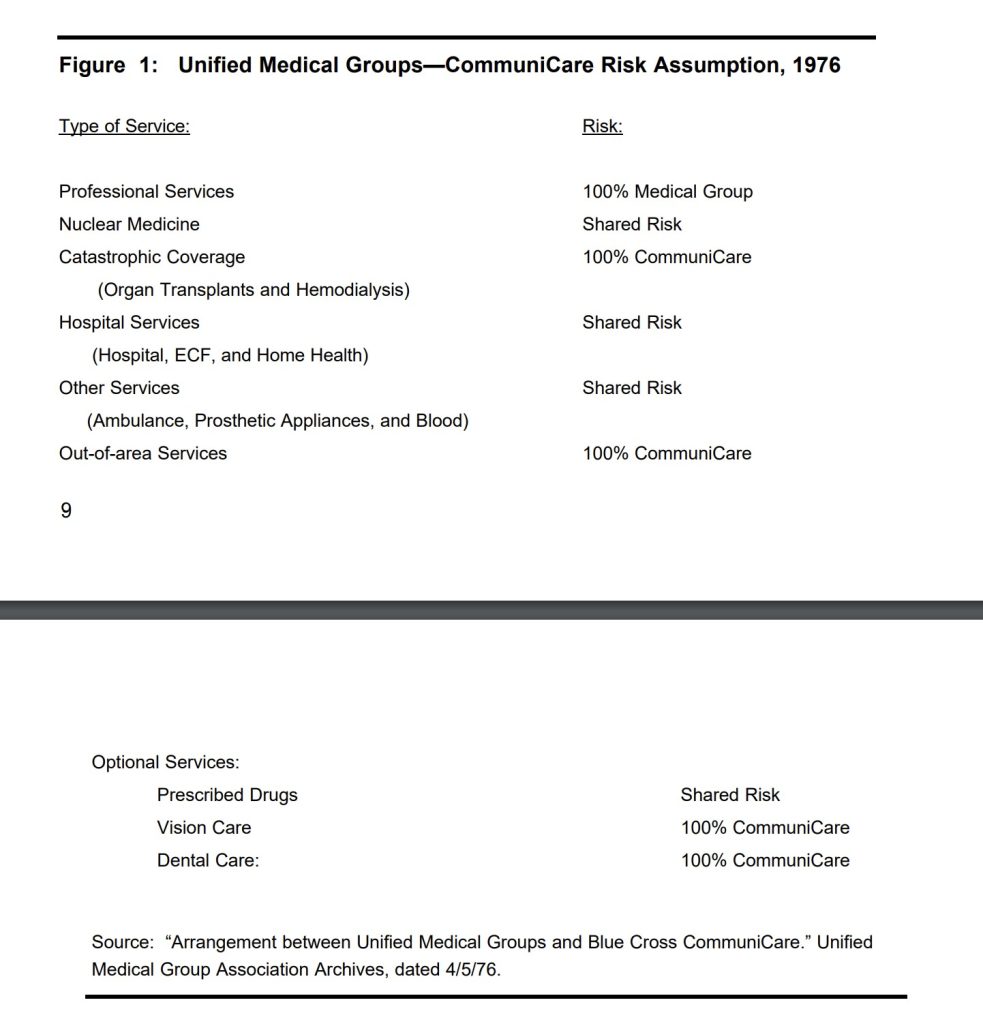

In Professional Services Capitation, a physician organization receives capitation payments only for all services of health care professionals; the payor and contracted physician organization usually have shared risk for institutional services (such as those delivered by a hospital, a nursing home, outpatient surgical facilities, or home health). The payor pays the capitated amount (as PMPM) for professional services to the physician organization and sets aside the agreed-upon amount (as PMPM) for institutional services in a risk pool. The payor pays hospitals and other facilities for the services they provide and divides any money left in the risk pool with the physician organization. If there is a shortfall in pool funds, the physician organization and payor share that liability (Foote, 1998). The physician organization that accepts professional capitation could be a multispeciality group or a primary care group that manages risk through contracting with specialists. Specialty managed care contracting requires all parties to understand their role in managing care, as well as carve-out and subcapitation agreements. In the same way, specialists that are contracting or recieving subcapitation need to know their referral sources, their costs for providing care, and how to provide care that meets their referral sources’ needs and the payers’ requirements, capitated entity needs to understand the ‘leakage’ out of speciality network as well as service area, cost of specialist services and procedures and as well as opportunitues to manage utilization, improve quality, patient satisfaction (Alexander 1999).

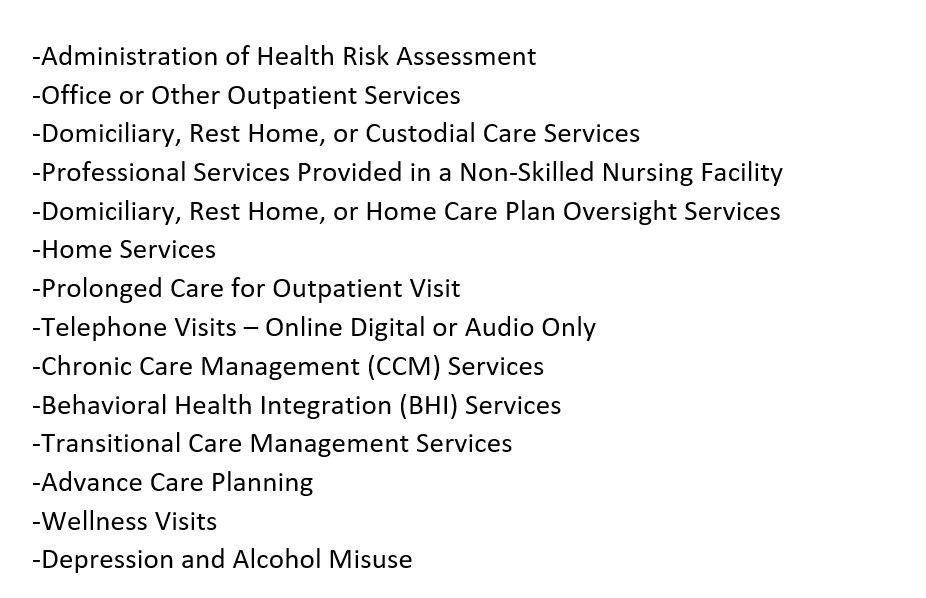

In Primary Care Capitation, groups receive capitation for primary care services only based on agreed upon CPT/HCPCS codes. In CMS Direct Contracting Model:Primary Care Capitation, following services considered for capitation

Operationalizing Risk in Provider setting

Without workflows and change in incentives/compensation, care and performance within/by capitated provider organizations might not be different that payors. Leading capitated organizations intentionally and incrementally build models of care to improve utilization and quality of care (Hansen 2016).

Risk of Capitation

The risks of capitation are undertreatment, substitution of inadequate mental health services, cost shifting to other service systems, and poorer treatment outcomes resulting from financial risks and incentives placed on the contract agency (Mechanic and Aiken 1989).

Risk Corridors

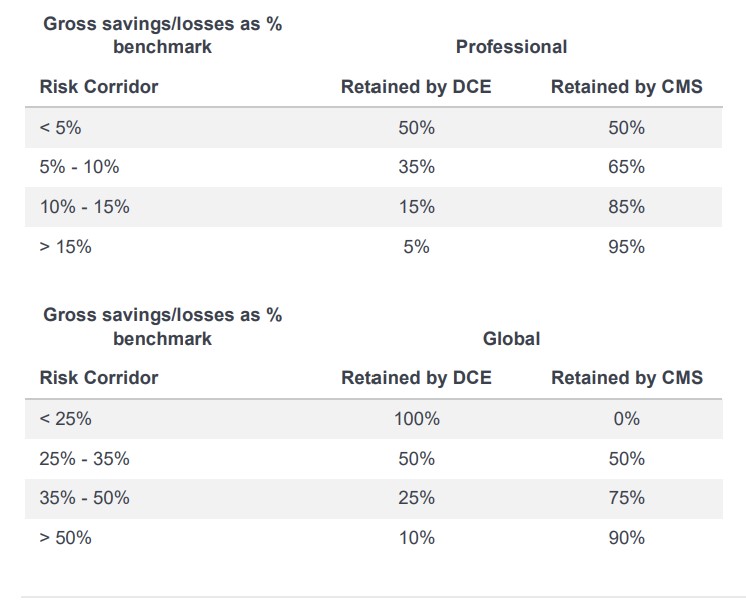

Risk corridors cap the shared savings/losses based on “risk bands” in a capitated agreement meaning that greater deviance from the Performance Year Benchmark will move the capitated entity to the next risk band, resulting in a lower percentage of shared savings/losses for experience within the higher band. For example, a DCE in the Professional Option would experience 50% of savings and losses within 5% of the benchmark, but would be exposed to only 35% of losses more than 5% above the benchmark (up to 10%, where another band with still-lower exposure would begin.

Stop-loss arrangements/Reinsurance

These prospective arrangements help capitated groups manage risk associated with outlier expenditures by limiting capitated entities financial liability for beneficiary expenditures above a prospectively determined cutoff. Depending on the arrangement between organizations, these arrangements might limit but not eliminate the financial risk by sharing the responsibility of cost such as a percentage of expenditures above the cut off, as incentive to continue managing costs.

Unique nuances of risk arrangements in Medicaid/Mental Health

In Medicaid programs , behavioral health services, dental services, pharmacy services are carved-out which is a managed care financing model where some portion of Medicaid benefits are separately managed and/or financed. For behavioral health benefits, the benefits are often broken down even further into specific service categories, including mental health outpatient services, psychiatric inpatient services, addiction treatment services, etc. Carve-outs developed to address rising inpatient behavioral health costs and limited insurance coverage. There are two types of behavioral health carve-out models:

- Primary carve-out: The payer (in this case Medicaid) excludes behavioral health services from the primary managed care contract. Behavioral health services are instead paid fee-forservice (FFS) by the state, managed by an administrative-services-only organization, or managed by a managed behavioral health organization (MBHO) in some type of capitated arrangement.

- Secondary carve-out: The payer (Medicaid) contracts all with a managed care organization (MCO) to manage all benefits, including behavioral health. The MCO then sub-contracts with another organization (an MBHO) to manage behavioral health services.

While approaching risk in Medicaid, its useful to understand carve outs, their unique challenges and burdens (e.g. care integration).

Given the challenge of establishing stable primary care for Medicaid patients with multiple health, mental health and substance abuse issues, anecdotally, payors are capitating new organizations for ‘high cost’ individuals. New organizations who accept capitation for these members, can provide care for these patients themselves or coordinate care with non-affiliated PCPs acting like an administrative-services-only organization.

References

Foote SM, Sprague L. Physician Organizations Assuming Risk: Market and Policy Implications Washington (DC): National Health Policy Forum; 1998 Nov 9.https://www.ncbi.nlm.nih.gov/books/NBK560461/

American College of Healthcare Executives Chapter 20: Capitation, Rate Setting, and Risk Sharing https://docplayer.net/59329113-Chapter-20-capitation-rate-setting-and-risk-sharing.html

Casalino L, Robinson J The evolution of medical groups and capitation in California (1997) Kaiser Family Foundation https://www.chcf.org/wp-content/uploads/2017/12/PDF-casalino.pdf

Foote SM, Sprague L Physician Organizations Assuming Risk: Market and Policy Implications Issue Brief, No. 727 Washington (DC): National Health Policy Forum; 1998 Nov 9.

Vigen GJ,Wernicke MD, Edward M, Pudlowski EM Value-Based Care through Physician Groups An Actuarial Business Perspective (2020) https://www.ccactuaries.org/docs/default-source/papers/physician-based-care-(august-2020).pdf?sfvrsn=bfd42889_5

Caliri S, Why you should build in primary care: a layman’s guide to risk delegation (2020) https://www.8vc.com/resources/why-you-should-build-in-primary-care-a-laymans-guide-to-risk-delegation

Hansen S, Stewart D Managing Cost of Care: Lessons from Successful Organizations (2016) https://www.chcf.org/publication/managing-cost-of-care-lessons-from-successful-organizations/

Alexander JM Managed care contracting for specialists Healthc Financ Manage 1999;Suppl:6-10.

Norris C, Jensen B, Grzeskowiak D Direct Contracting: A program summary and comparison with MSSP and NGACO (2020) https://us.milliman.com/-/media/milliman/pdfs/articles/direct_contracting_a_program_summary_and_comparison_with_mssp_and_ngaco.ashx

Mechanic D, Aiken L. “Capitation in Mental Health: Potentials and Cautions.” In: Mechanic D, Aiken LH, editors. Paying for Services: Promises and Pitfalls of Capitation. San Francisco: Jossey-Bass Publishers; 1989.

Open Minds Market Intelligence Report Which State Medicaid Plans CarveOut Behavioral Health Benefits? (2016) https://openminds.com/wp-content/uploads/indres/BH-Carve-outs-July-Updare-072816-alm.pdf

Frank RG, Garfield RL Managed Behavioral Health Care Carve-Outs: Past Performance and Future Prospects Annu. Rev. Public Health 2007. 28:303–20 https://www.annualreviews.org/doi/pdf/10.1146/annurev.publhealth.28.021406.144029

Types of managed care arrangements https://www.macpac.gov/subtopic/types-of-managed-care-arrangements/

MACPAC Issues in Setting Medicaid Capitation Rates for Integrated Care Plans https://www.macpac.gov/wp-content/uploads/2013/03/Issues-in-Setting-Medicaid-Capitation-Rates-for-Integrated-Care-Plans.pdf

CAPG’s Guide to Alternative Payment Models: Case Studies of Risk-Based Coordinated Care: A CAPG white paper (2016) https://www.pcpcc.org/sites/default/files/resources/APMGuideFinal.pdf